OUTLOOK | April 24, 2023

Middle market organizations must understand changes in the energy landscape

For the first time, energy transition investment is on the brink of overtaking fossil fuel investment. Looking ahead to the next 12 months, rising energy demand, expanding policy aid and healthy balance sheets will incentivize the industry to continue aggressively investing in the energy transition. This shift will reshape the way organizations power their businesses.

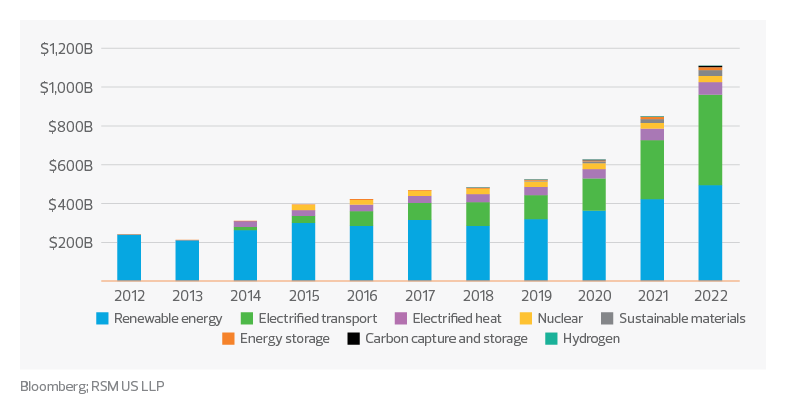

Let’s consider the data around the rise in energy transition investment. In 2022, global energy transition investment—defined as investment in long-term structural change across industries—totaled $1.1 trillion, up 31% from the prior year. In particular, investment in electrified transport and renewable energy (wind, solar, biofuels, biomass and waste, marine, geothermal, and small hydro) is leading the pack. Renewables are still the largest segment of investment, but electrified transport is the fastest-growing (up 54% in 2022 as compared to 17% for renewables).

“The industrial sector is challenging to decarbonize given its heavy use of fossil fuel and complex processes that cannot be reconfigured overnight. But more possibilities exist now than ever for organizations to reduce their carbon footprint.”

Anne Slattery, Industrials Senior Analyst, RSM US LLP

Global energy transition investment

Numerous factors are driving this investment at a time when inflation is high and recession fears are prevalent. The recent energy crisis spurred by the Russia-Ukraine war and resulting focus on energy security have accelerated the push to invest in fossil fuel alternatives. The need for reliable, affordable, and clean energy sources became glaringly evident as geopolitical tension and longtime underinvestment in production wreaked havoc on energy markets over the past year.

The industrial manufacturing sector plays a crucial role in the success of the energy transition and meeting U.S. net-zero goals, as it accounts for 24% of greenhouse emissions in the United States, according to Bloomberg. This is one of the most challenging sectors to decarbonize given its heavy use of fossil fuel, expensive equipment and complex processes that cannot be reconfigured overnight. However, more possibilities exist now than ever before for industrial organizations to reduce the carbon footprint of their operations.

Decarbonization opportunities, both direct and indirect, will be at the top of the priority list for industrial manufacturers over the next decade. Here are some specific actions companies might take toward meeting the broader goal of decarbonization:

Increase energy efficiency

Assessing how your organization powers buildings and operations is a great place to start and can yield both environmental and cost-saving opportunities. Metrics to consider include current monthly or annual energy consumption and how usage ebbs and flows at various times. Creating an organization-wide energy management program with appropriate leadership and ongoing monitoring is an important first step in understanding and taking control of your energy usage.

Incorporate electrified transport

The progression of electric vehicles and related technology presents a huge opportunity for organizations to reduce their carbon footprint. While the electrification of passenger vehicles currently accounts for the bulk of EV adoption, commercial EV spending hit nearly $8 billion last year, nearly double compared to 2021. This was mostly driven by the accelerating deployment of light commercial vehicles, according to Bloomberg. Organizations need to develop a strategy around how they will adopt electric vehicles and address the overall impact on the organization.

Diversify fuel sources

While many industrial manufacturers have made the switch from coal to natural gas, the rising investment in renewable sources of energy—such as solar, wind and renewable natural gas—indicates that companies need to consider how these sources can play a role in their future energy portfolio. Solar energy is driving the most growth in the renewables sector; the U.S. Energy Information Administration expects triple the solar capacity installations in 2023 compared to 2022. While fuel diversification will be positive for both the environment and for organizations’ operating models in the long run, it will take careful planning to avoid any reliability issues in the short term. Every business will have different needs and considerations to factor into its long-term planning.

Procure cleaner materials

Procurement practices set the foundation for the manufacturing process, and thus, are an important step in establishing a cleaner process from start to finish. Additionally, enforcing environmental standards within the procurement process sends demand signals to the marketplace that emissions generated in producing materials are a factor when making buying decisions.

While investment in renewable energy is clearly increasing, it still may not be enough to achieve the 2050 net-zero goal. Policy changes and private investment will be crucial for this investment to continue to grow and, ultimately, accelerate. One program for industrial manufacturing organizations to watch closely is the U.S. Department of Energy’s new Industrial Demonstrations Program. This program, funded partially by the Inflation Reduction Act, will mark the largest investment in industrial decarbonization in American history, at $6 billion of funding.

TAX TREND: Energy

Several green tax credits and incentives programs, many of which were enacted in 2022 as part of the Inflation Reduction Act, offer significant financial benefits that offset some of the investment costs made to achieve the energy transition.

Eligible uses of the funding include smart manufacturing technologies, sustainable manufacturing measures, and efforts to make manufacturing processes more energy efficient. Industrial organizations of all sizes should determine whether they may be able to take advantage of any funding available from this program.

It is important for middle market organizations to understand how the landscape of the energy market will change over the next decade and what the new energy mix and related technologies will mean for their business. To meet emission reduction goals, organizations of all sizes will need to invest in clean energy technology and diversify the sources of energy they use day to day. Leadership teams will need to stay abreast of emerging policies that can assist organizations in the quest for a cleaner future.

This article was originally published on RSM US LLP.

Let’s Talk!

Call us at 1 855 363 3526 or fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Anne Slattery and originally appeared on 2023-04-24. Reprinted with permission from RSM Canada LLP.

© 2024 RSM Canada LLP. All rights reserved. https://rsmcanada.com/insights/industries/energy/rising-energy-transition-investment.html

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.