ARTICLE | June 09, 2023

Supply chain stresses, shifting end-consumer demand, and forecasting challenges over the last three years have left many companies grappling with elevated inventory levels. As a potential recession looms, inventory levels pose significant financial risks for businesses, especially those in the industrial and consumer products industries that did not take the necessary steps to reduce inventory levels over the last six months. The market complexities of predicting tomorrow’s demand make it essential for organizations to adopt a data-driven inventory management strategy.

Forty-eight percent of firms with inventories saw their supplies increase in the second quarter, according to the latest RSM US Middle Market Business Index survey—that’s down from 52% in the prior period. However, 60% of respondents expect inventory levels to increase over the next six months, a concerning statistic given inventory challenges companies have faced recently.

Gone are the days of making business decisions based solely on intuition or using strategies carried over from the past. With the democratization of predictive analytics and artificial intelligence, more precise technological tools can help companies reduce guesswork, mitigate risk and increase certainty. While the current interest rate environment makes lending for capital-intensive projects more expensive, companies should weigh the cost of forecasting errors against the cost for solutions that drive efficient use of working capital and increase profitability.

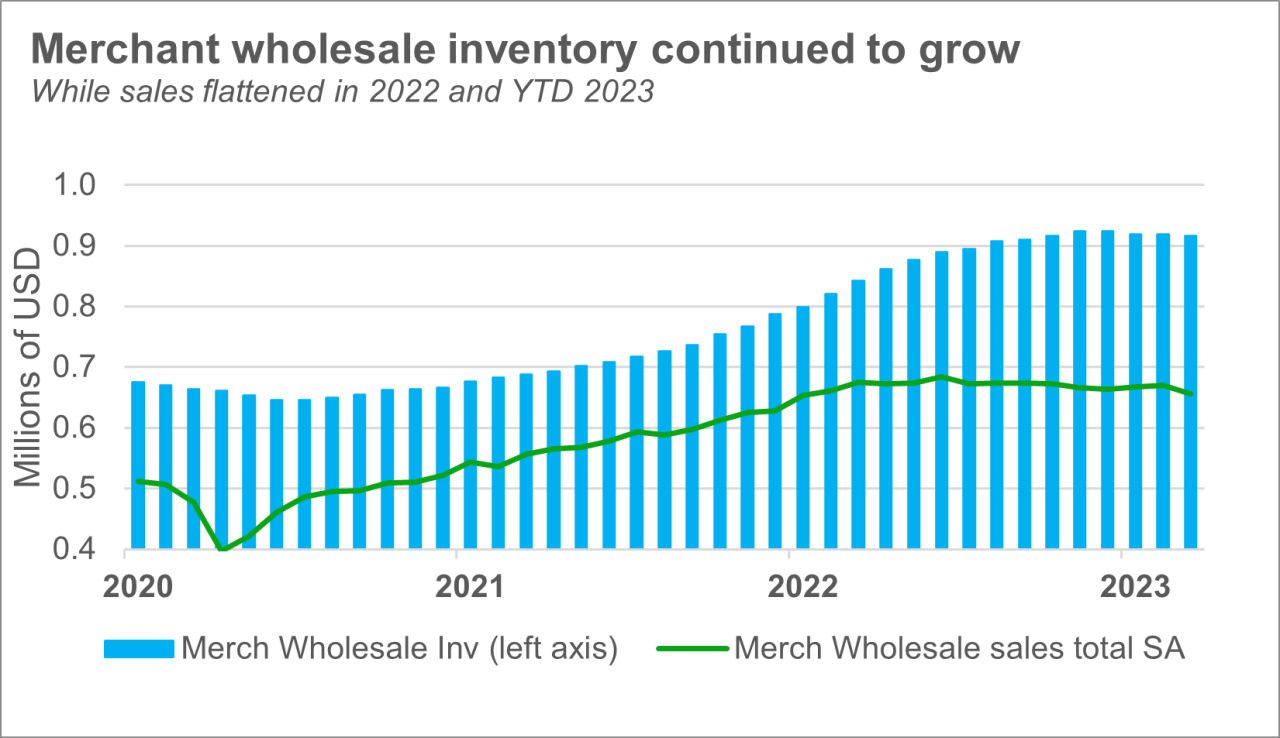

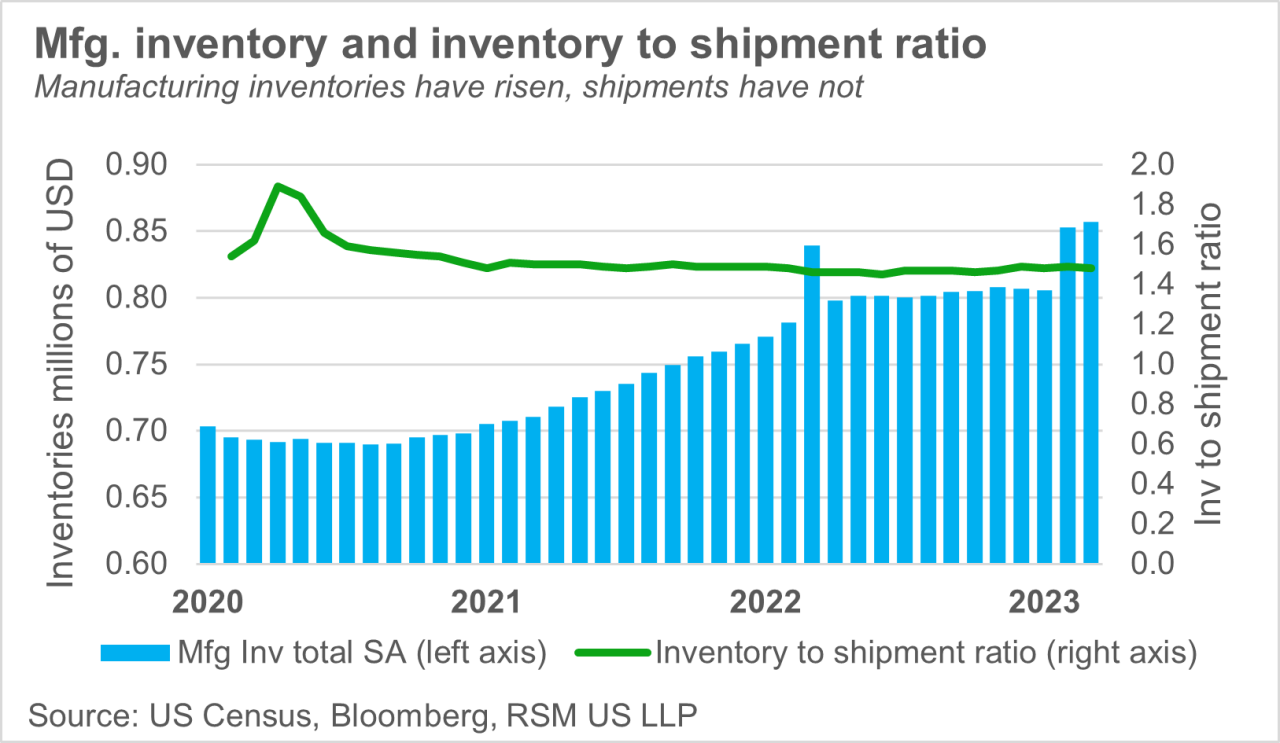

While retailers have taken the necessary steps to reduce inventory levels through discounting in the face of waning consumer demand, wholesalers still find themselves grappling with excess inventories. Middle market organizations tend to bear the brunt of current inventory stress, because they have less capacity to absorb margin hits compared to their larger counterparts.

Below we explore key issues, as well as how companies can mitigate the risks associated with current inventory levels and why a data-driven approach is central to such efforts, especially for manufacturers and consumer products companies.

Top inventory issues

Businesses with long lead times to acquire raw materials and inventory that is historically slower moving have been especially hard hit. An example would include heavy-equipment dealers and other wholesalers that source from Asia and have significant resources tied up in working capital. Many have experienced elevations in some or all of these effects:

- Oversupply: Overstocking to compensate for partially filled orders and stockouts

- Stockouts: Product unavailability due to lack of components or logistical supply issues

- Forecast errors: Costly material misses in forecasts which burden working capital with higher inventory levels, limiting companies’ ability to turn goods into cash to fund operations

- Lackluster processes: Inaccurate or unavailable data and a lack of standard, process-driven rigor in inventory management

- Too many SKUs: The proliferation of product offerings and variations has been a pain point, especially because some of that product is slow-moving and low-margin, trapping cash

Consumer spending has remained resilient overall, but with RSM US LLP putting the chance of a recession at 75% over the next 11 months, potential job losses will deflate the tailwinds supporting consumer spending patterns. Cracks are already beginning to form in consumers’ willingness to spend on apparel, home furnishings, recreational goods and other categories that experienced outsize growth earlier in the pandemic.

Adopting a data-driven approach to inventory management

Businesses that operate on thin or shrinking margins are continuously investing to make core processes more efficient and integrate predictive analytics throughout the organization. Typical results RSM has seen for successful projects intended to address inefficiencies include significant returns on investment, such as 8% to 18% savings in procurement, 5% to 30% reductions in operational costs and 5% to 22% in logistics savings.

Let’s Talk!

Call us at 1 855 363 3526 or fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Matt Dollard, Mike Graziano, Nick Stuart and originally appeared on 2023-06-09. Reprinted with permission from RSM Canada LLP.

© 2024 RSM Canada LLP. All rights reserved. https://rsmcanada.com/insights/economics/elevated-inventory.html

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.