ARTICLE | March 22, 2023

Family offices are focusing on operational excellence to drive efficiencies and future-proof the organization in a constantly changing environment.

Family offices continue to be the preferred way for ultra-high net worth individuals and families to manage assets and to support the goals and legacy of their family. But today the existing 14,000+ family offices across the globe are facing new challenges and complexities, raising concerns about whether their operating model is providing the transparency and efficiency needed to be successful today while being flexible enough for tomorrow.

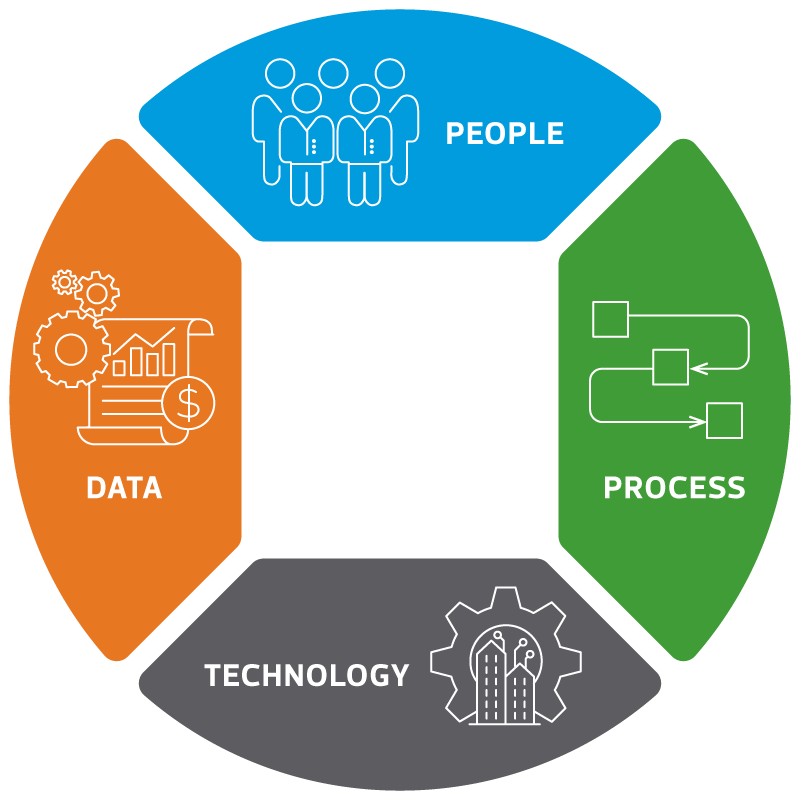

Rather than being reactive, leading family offices are focusing on operational excellence to accomplish the family goals and objectives. By assessing and creating roadmaps around people, process, technology, and data, leading family offices can have an organization that truly delivers the control, flexibility, and visibility needed to meet their needs.

Four pillars of operational excellence

People, Process, Technology and Data

The time is now for operational change

An operating model serves as the strategic roadmap for how a family office organizes its resources and capabilities to create synergies within the family office and throughout the enterprise, including the family’s operating businesses and investment structure.

There are great risks when relying on outdated models, manual processes, and technologies that are non-integrated when trying to meet the complex financial needs and investments of the family and manage future changes. Effective planning strategies are successful when the four pillars of people, processes, technology and data are optimized and in sync to truly transform your family office into an agile and highly efficient organization that drives growth for the family.

People: The most important asset of every family office

Do you have a sustainable human capital strategy that delivers the right outcomes for your family office?

Family offices require high performing and engaged teams with the competencies to manage the complex needs of the family.

Family offices also struggle with a tight talent pool that requires new strategies to attract and retain workers possessing specialized knowledge and skills. At the same time, key personnel spend significant time on completing manual, redundant processes, which often require additional or unnecessary resources.

Closing the talent gap and aligning people to the right roles are top of mind for family offices, with careful thought given to diverse staffing approaches, including in-house talent and outsourcing.

People: Questions for family offices

- Do we have the right people with highly technical and digital competencies to drive value?

- Are we attracting, developing and incentivizing our talent in a competitive job market?

- Are the right advisors seated at the table; if not, what are the ideal candidates for key roles?

Process: The blueprint for how work gets done

At what cost to productivity and value creation?

From a heavy reliance on excel spreadsheets to manual data entry, inefficient processes are found in everyday operations.

Inefficient and manual processes can result in errors and labor-intensive staff constraints. With re-designed and optimized processes with clear controls, you’ll save time, increase compliance, reduce risk and costs, and enhance employee performance.

Process: Questions for family offices

- Do we have standardized and efficient processes and performance metrics?

- What are the underlying issues and key risk factors that would help inform our future roadmap for streamlined processes?

- Are key stakeholders on board with change so that family office initiatives align with family objectives?

Technology: The engine that powers the enterprise

Where are the real savings?

Many family offices rely on legacy technology systems that are disconnected, outdated and ineffective in running a modern enterprise. In addition to being inefficient, aging systems are more susceptible to cybersecurity risks and often require more maintenance than their newer counterparts. Where are the real savings?

Embracing technology doesn’t have to disrupt the family enterprise. Change management can help ease the transition, starting with enhanced, cross-enterprise technology and that leads to accurate and timely reporting within a more robust integrated architecture.

Technology: Questions for family offices

- How can we increase visibility and insights while decreasing reliance on multiple non-integrated technologies?

- What are key opportunities to design a future-state technology roadmap?

- What are the biggest challenges to going digital?

Data: The key to confident decision-making

What impact could this have on business and investment decisions?

The fragmentation of data is a challenge for many family offices. The more data a family office regularly pulls from different sources and stores in siloed locations, the harder it becomes to access that data and maximize its usage.

Leveraging data enables family offices to turn valuable information into actionable insights to drive family goals forward.

Data: Questions for family offices

- How easy (or difficult) is it to extract data to provide accurate, real-time reporting?

- How is data being used to support strategic planning?

- What is the risk of a data breach and is there a cybersecurity plan in place?

Next steps for future-proofing the family enterprise

Watching a new era unfold understandably raises many considerations for family offices—most importantly, how to grow and mature the family enterprise to sustain multigenerational success. An operating model is a fundamental driver of a family office’s strategic road map for the enterprise; however, its usefulness diminishes if traditional approaches are not adapted to keep up in a fast-moving world.

A focus on operational excellence and bringing the application of the right people, processes, technology and data can be the key to a family office achieve its long-term goals.

Let’s Talk!

Call us at 1 855 363 3526 or fill out the form below and we’ll contact you to discuss your specific situation.

Source: RSM Canada LLP.

Reprinted with permission from RSM Canada LLP.

© 2024 RSM Canada LLP. All rights reserved. https://rsmcanada.com/insights/services/family-office/Is-your-family-office-reaching-its-full-potential.html

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.