ARTICLE | March 16, 2023

Heightened uncertainty around global financial markets due to rising interest rates, inflationary pressures, valuations and a challenging labour environment has created instability for private equity general partners, leading them to take a more cautious approach to deals.

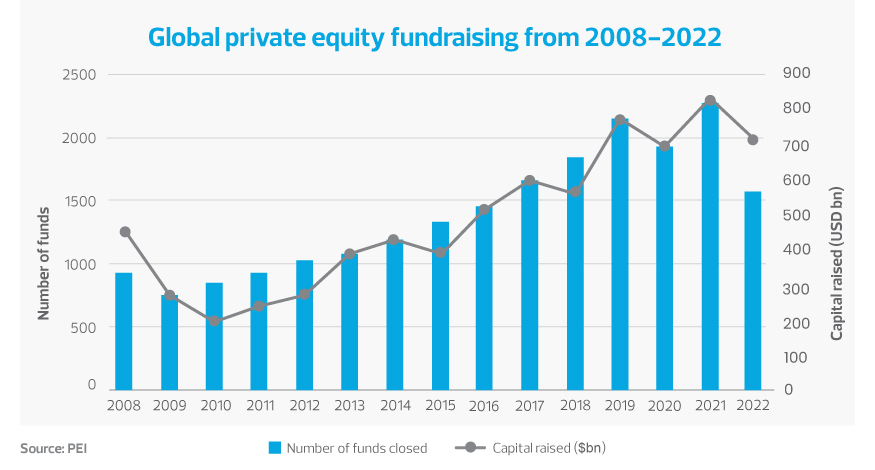

In 2022, the real estate market saw a contraction and concentration of equity placed across fewer funds. According to data from Private Equity International, $727.6 billion was raised across just 1520 funds. While that $727.6 billion represents the fourth-highest year of PE investment on record, this also marked the lowest number of funds to have received investment since 2016, suggesting that a smaller number of funds accounted for a larger share of the total capital raised.

This trend has led to middle market private equity fund managers feeling intense pressure to try and get a piece of the pie. Getting ahead of the competition requires meeting ever-increasing demands for data and transparency, which calls for firms to embrace digitalization. The need for specialized investor services also continues to grow and often includes tax and structuring advice, complex accounting and waterfall analysis, valuation support, business strategy development, and forecasting, among other deliverables.

Fortunately, recent shifts in the fund services space and technological advancements have made it possible for middle market managers to create an institutional-grade environment for limited partners. Employing strategies to better deliver on deadlines and provide peace of mind to limited partners will help position smaller funds to thrive in today’s uncertain market.

Building credibility with a premier back office

Established and emerging managers must show they can execute without distraction, which starts by answering questions weighing heavily on investors’ minds: Who does the fund rely on to perform critical functions? Is the fund able to deliver complete, accurate, timely and quality reporting? Does the fund work with reputable third parties? And can the fund deliver real-time portfolio insights?

Finding and retaining the right people to handle critical back-office functions is a constant challenge, and it can delay fundraising efforts or hamper responsiveness to investor needs. To help fill talent gaps, outsourcing has become an increasingly desirable option.

Relying on a third-party administrator helps fund managers deliver timely and thorough reporting to investors with greater levels of control, quality and consistency. In the event of an audit, having financials reviewed by a third party with a reputation for accuracy will help instill confidence. Conversely, a self-administered fund could raise red flags to investors, auditors and regulatory bodies during due diligence.

Embracing digital transformation

Just as self-administering back-office functions poses risks and inefficiencies, so does attempting to maintain legacy fund administration processes. Managers who fail to keep up with innovation are destined to be left behind.

Investing in automation is the path forward. Funds that lag in technology adoption will face mounting pressure to deliver real-time performance metrics and increased transparency to investors. Funds must digitalize to be able to compete in a world accustomed to gaining instant access to information. It will soon be unheard of to wait 45 days post-quarter to receive fund data and insights; in the future, it will take seconds.

For many funds, it is a build-or-buy decision; however, it is critical to recognize that technology is not a one-time investment but a continuous and evolving transformation journey. Onboarding and utilizing technology platforms requires significant technical expertise as well as financial and human capital resources. As fees compress and costs increase, managers must manage every dollar, and information technology maintenance is a major consideration.

Again, outsourcing helps solve many of these issues. Instead of having to develop a technology strategy and wade through applications, fund managers can rely on a third party to make the right decisions as fiduciaries for their many clients based on their experience. Ideally, a service provider will have cross-functional teams consisting of IT and business professionals to offer a truly integrated investor experience.

Enhancing the fund’s ability to grow

The ability to grow and maintain resilience in today’s market means fund managers need to demonstrate they can execute without distraction. For established and emerging funds, a manager’s core responsibility is successfully driving investment performance—and much of that success now depends on the ability to provide operational excellence and an ever-growing list of services and solutions to meet investors’ demands.

To keep up with limited-partner demands, many funds have forged strategic partnerships with multiple service providers, which raises important considerations. While one company may be great to work with on an individual basis, it doesn’t mean it can effectively collaborate with other providers, which only complicates a manager’s responsibilities around vendor management.

If a manager is unable to perform effective vendor oversight, it could lead to increased risk and decreased efficiency. In the event a vendor relationship doesn’t work out, the last thing a fund manager wants is to have to find a replacement, go through the due diligence process again, and explain their decisions to investors and potentially regulators.

One solution to this challenge is the consolidation of fund administrators through increased merger and acquisition activity, which has led to a rise in specialty fund services providers. In addition to handling foundational fund administration functions, many of these consolidated providers are offering supplemental services such as valuation; environmental, social and governance advisory; and IT management.

Fund managers should look for a service provider that can scale to support growth without lag. Even better, an advisor should also be credible across multiple disciplines and be able to provide insight into every direction of the market and help navigate proposed regulations, including ESG reporting.

Let’s Talk!

Call us at 1 855 363 3526 or fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by William Andreoni, Troy Merkel and originally appeared on 2023-03-16. Reprinted with permission from RSM Canada LLP.

© 2024 RSM Canada LLP. All rights reserved. https://rsmcanada.com/insights/industries/private-equity/how-pe-funds-can-build-credibility-and-resilience-in-an-uncertai.html

RSM Canada LLP is a limited liability partnership that provides public accounting services and is the Canadian member firm of RSM International, a global network of independent assurance, tax and consulting firms. RSM Canada Consulting LP is a limited partnership that provides consulting services and is an affiliate of RSM US LLP, a member firm of RSM International. The member firms of RSM International collaborate to provide services to global clients but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmcanada.com/about for more information regarding RSM Canada and RSM International.