Is CRA implementing a new authorization policy?

Do you need to speak to CRA on behalf of corporation? CRA appears to be implementing a new requirement for level 3 authorization.

Canadian payroll obligations for foreign employees working in Canada

With many employees working remotely, your company’s payroll compliance for foreign employees is more complicated.

Massive overhaul on the horizon – Significantly expanded form T1134

Be prepared for sweeping information disclosure changes related to reporting of foreign affiliates to form T1134 coming in 2021.

Tax updates in Canada in response to COVID-19

Our tax alert summarizes the latest tax measures by federal and certain provincial government authorities amid the coronavirus pandemic.

Krumm versus The Queen decision clarifies tax shelter definition

Would property be a tax shelter if the tax attributes are communicated but the tax benefits are not? In Krumm, the TCC held that it would.

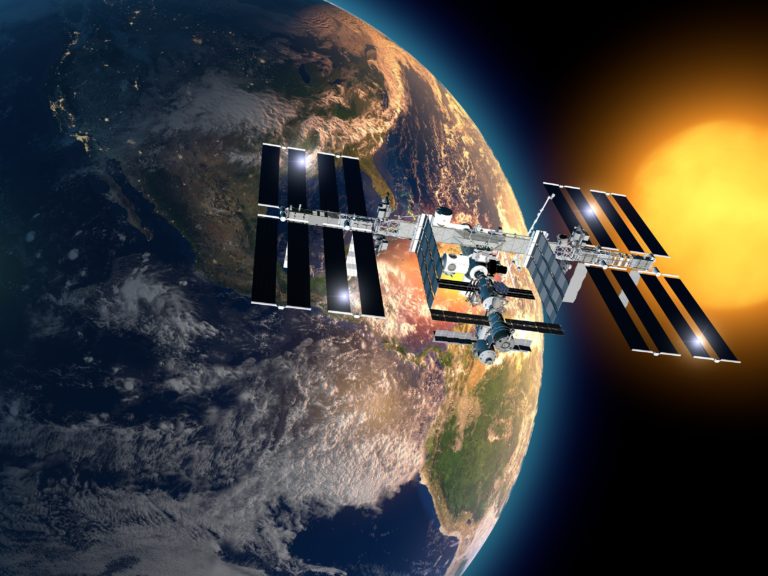

FCA confirms that a space trip is taxable to company shareholders

Find out how shareholder benefits could arise and the potential income tax implications as a result of the In Laliberté vs Canada decision.

Customs valuation and tax transfer pricing

Companies importing goods into Canada often face duties, tariffs, and other compliance items driven by the imported goods value.

Should you resort to mutual agreement procedure?

Canada implemented the mutual agreement procedure as an effective tool for resolving economic double taxation issues.

Restrictions on discretionary trust’s dividend allocation powers

If the word ‘discretionary’ means ‘unrestricted’ or ‘unregulated’, does that mean discretionary trusts have unfettered decision-making?