Your Business News

Strategic tariff planning for supply chain cost optimization

December 5, 2022

Authored by RSM Canada LLP

Ian L. FitzPatrick, CPA,CA, CBV shared this article

ARTICLE | December 05, 2022

Many companies that have tapped international markets to drive growth over the past decade face significant downward pressure on margins and competitiveness due to ongoing global supply chain disruptions and rising tariffs driven by trade disputes.

In response, operations, finance, and tax leaders are increasingly tasked with assessing the effects and developing strategies to reduce risks and costs. Some have found success at the intersection of supply chain and international trade by focusing on landed-cost planning. They have turned to various strategies and tactics to help reduce cross-border expenses, improve competitiveness and grow margin.

On the whole, indirect taxes, such as customs tariffs, value-added taxes, and excise taxes, can significantly affect a company’s ability to compete in global markets against other enterprises, both foreign and domestic.

Commonly—and seemingly more intensely over the past few years—tariffs can be used by governments as an instrument of domestic market protection to drive changes in trading partner behaviors or as a means to fill treasury coffers. As an above-the-line expense often buried in the costs of goods sold, tariffs often can be overlooked but may have a profound impact on the price paid to bring products to market. Occasionally, they may even be the difference between profit- or loss-making global business ventures.

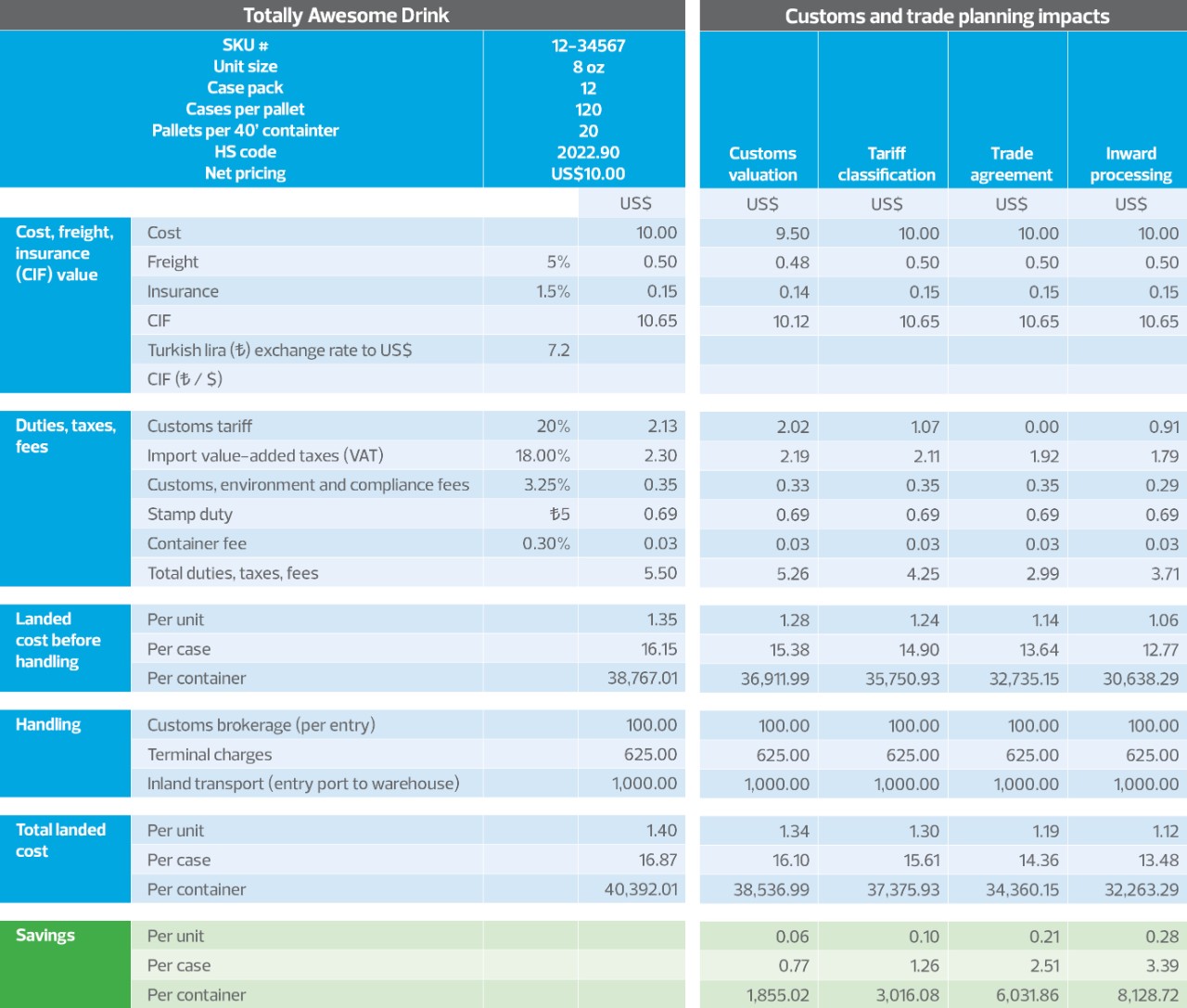

To help underscore the potential effects of tariff planning in cross-border supply chain operations, we present a sample landed-cost analysis of a product alongside several customs and trade strategies that can significantly lower the expense to get that item to market.

Whether through lowering the declared price of that product, changing the tariff classification (and thus the applicable duty rate), qualifying for a trade agreement, or utilizing a special customs program, the net result from such proactive planning is a more competitively priced product that can result in greater margins and market-share gains.

Indirect taxes—including tariffs—are often overlooked but can significantly affect the landed cost of goods. As shown in the chart, substantial savings can be achieved with careful analysis and planning, potentially leading to improved profit and competitiveness.

Let's Talk!

Call us at 1 855 363 3526 or fill out the form below and we'll contact you to discuss your specific situation.

No article attribution

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

FCR a proud member of RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how FCR can assist you, please call us at 1 855 363 3526