Your Business News

Law firms: decreased demand, increased expenses show challenges ahead

January 17, 2023

Authored by RSM Canada LLP

Joel A. Humphrey, CPA, CA shared this article

OUTLOOK | January 17, 2023

The sentiment among law executives in 2022 is drastically different from 2021, which was one of the most profitable years on record for the legal sector. The Thomson Reuters Law Firm Financial Index, which measures law firm market performance, fell to an all-time low in the third quarter of 2022, marking the fifth consecutive quarterly drop.

Although demand growth for law services has dampened, sticky elevated expenses related to 2021 and 2022’s labor challenges are of greater concern to law firm executives as they anticipate a cooling economy. Additionally, a third consecutive quarterly decline in productivity shows the ugly side of the “new normal” and suggests disorganized digital transformation may be a factor—contributing to an environment in which both lawyer mental health and productivity are at stake.

We have seen some layoffs within firms that serve primarily technology clients, as well as those that notably overhired in 2021. However, the labor market for lawyers remains competitive. In sustained labor market tightness, productivity should remain a top priority for firms, and we unpack solutions regarding billing policies and application rationalization that will help firms drive a competitive advantage.

Dampening demand

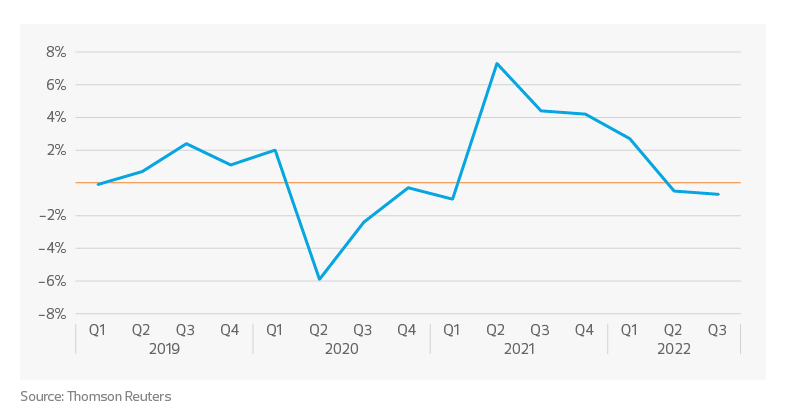

According to Thomson Reuters, demand for law services dropped for the second consecutive quarter, contracting by 0.7% in the third quarter, following a growth rate of negative 0.5% in the second quarter. This decline has been driven largely by the decrease in demand for legal services related to mergers and acquisitions, which was 13.7% lower than in the third quarter of 2021. That decrease is no surprise, as initial public offerings were 57% lower globally in the third quarter of this year than in the same period last year.

Although demand has dipped into the negatives recently, it’s important to note that this signals more of a return to pre-pandemic growth, as 2021 growth rates were elevated following the sharp decline of 2020. It would be more troublesome to see numbers decline in the first quarter of 2023—but for now, demand for law services in general can be viewed as steady.

Year-over-year demand for law services

Middle market firms have fared better than the largest law firms in terms of demand. At the halfway point of 2022, midsize firms outperformed the Am Law 100 with 1.7% demand growth versus a decline of 0.2% for the larger firms.

Sticky expenses

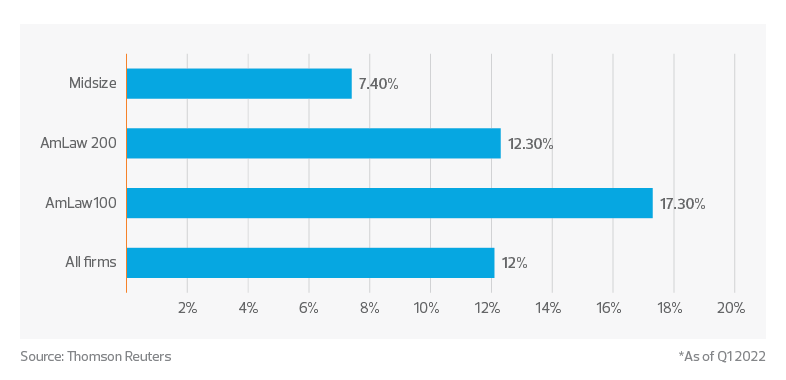

Direct and overhead expenses for the third quarter increased by 10.9% and 12.8%, respectively, over the same quarter last year, following double-digit growth the previous quarter as well. Unfortunately, elevated direct expenses, particularly those driven by associate rate increases of 2021, are here to stay. Wage increases are sticky, and law firms have used sharp increases in compensation as their first line of defense in attracting and retaining talent over the past few years.

Midsize firms were much more conservative in associate compensation increases than larger firms, which in the short term caused higher turnover rates.

Year-over-year increase in associate compensation*

Lower sustained associate increases now give midsize firms a competitive advantage as they have more margin to play with when making decisions about rate increases next year—something that clients will certainly be watching in case of an economic slowdown.

The battle for labor

Although many firms are ready to put the battle for labor behind them, many practice areas that aren’t directly correlated with the economy are still hiring. Bloomberg identifies these areas as litigation, privacy, data security, intellectual property, employee benefits and tax. Additionally, midsize firms are still hiring as they recover from associate ranks being thinned by larger competitors during the economic boom of 2021.

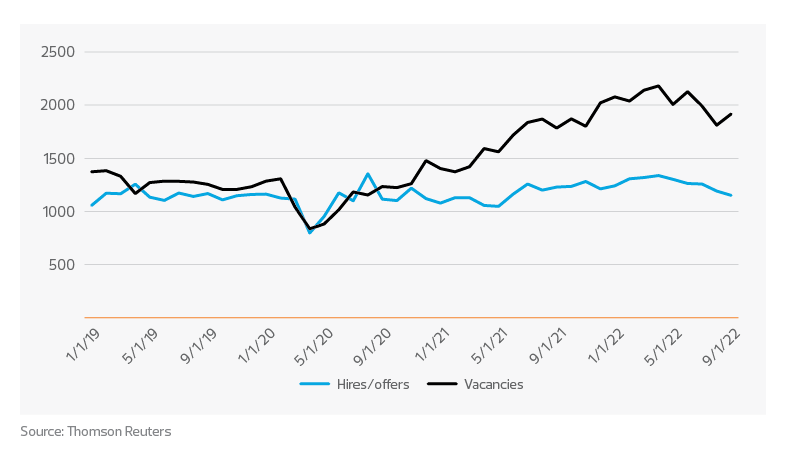

Although larger law firms have cooled hiring efforts, the labor market still remains tight across all professional services firms, which will keep labor-related expenses high for the foreseeable future.

Professional and business services labor

The gap between hires and vacancies in professional services remains unprecedently high. The trend of a shrinking gap reversed with September’s labor report that shocked the economic community. This gap is expected to tighten with economic cooling, but it’s not a problem that will be solved overnight. For law firms that are still hiring, the labor market remains competitive.

Despite the tight labor market, some law firms tied to technology are slowly announcing layoffs as the fourth quarter comes to a close. If productivity continues to fall, we expect these layoffs to be more prominent and reverse the tightness in the labor market.

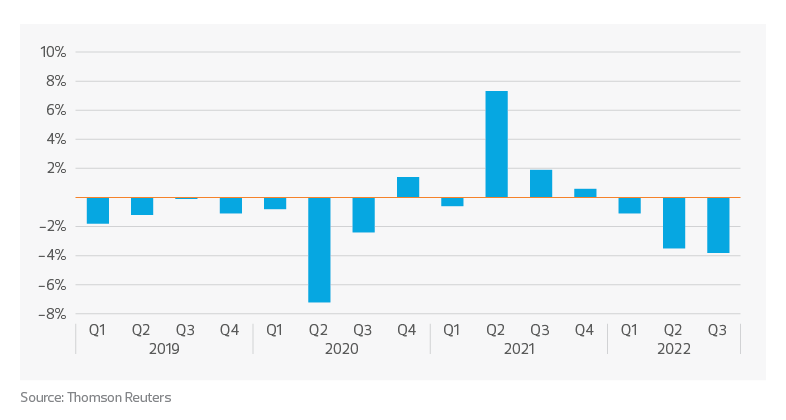

Productivity at law firms

Perhaps the most concerning factor of the third quarter is that productivity has continued to slide, decreasing 3.8% following two consecutive quarterly declines, according to Thomson Reuters. Productivity has been a critical success factor over the past year as firms strive to keep up with demand during significant labor shortages, and it will continue to be key. The focus will be on a firm’s ability to remain competitive and provide value to their clients if there is an economic downturn.

Year-over-year growth in lawyer productivity graph

Again, midsize firms have a slight advantage when it comes to productivity. At midyear, the average midsize firm’s productivity declined by 1.8%, as opposed to a 3.3% decline in the Am Law 100. This is beneficial for midsize firms that face heightened labor challenges, and it signals that Am Law 100 firms may have slightly overhired associates throughout 2022. It’s important to note that there have not been significant layoffs outside of a few select firms closely tied to technology companies. However, more firms may consider layoffs if productivity continues to slide.

Remote work a double-edged sword?

Productivity is critical to the financial well-being of a firm and, perhaps just as importantly, to the mental well-being of lawyers. In a 2022 mental health survey by the American Bar Association, 74% of lawyers reported that their work environment contributed to mental health issues. Two notable concerns included billable hour pressure (59%) and lean staffing (49.5%). The percentage of lawyers that reported anxiety in 2022 is an uptick from a similar survey conducted in 2020, showing that the problem is getting worse.

The Microsoft Work Trend Index Special Report found that meetings per week increased by 153% globally for the average Microsoft Teams user since the start of the pandemic, as many firms adopted remote working policies that have been adopted permanently. Additionally, overlapping meetings increased by 46%, and 42% of meeting participants said they multitask during meetings by actively sending emails or pings.

At first glance, these numbers suggest that productivity has increased—but back-to-back and overlapping meetings may be contributing to a decline in productivity. During a meeting discussing a matter for one client, emails are likely sent on matters for other clients. These efforts, and the time spent on them, are often not tracked, and billable client time may slip through the cracks.

To mitigate these losses, law firms need to update policies and guidelines—particularly for junior staff—on what constitutes billable time and how to capture it. Clear policies and education will allow firms to capture missed time and improve productivity.

Technology landscapes

Over the past decade or so, law firms have invested in digital transformation, often adding multiple ancillary systems to automate or streamline parts of the business. However, complex or disorganized application architectures may also be contributing to a drain on productivity. In August, the Harvard Business Review reported that a study it conducted found that switching between applications takes over two seconds, and the average user toggles between different apps and websites nearly 1,200 times each day. Over the course of a year, that adds up to five working weeks, or 9% of their annual work time.

Practice management and financial systems for law firms have improved drastically over the past few years, and can often replace up to five existing ancillary systems. Law firms should review their current application architecture and see where application rationalization makes sense. This exercise will not only streamline workflows and decrease toggle time, but also potentially provide significant financial savings through the consolidation of licensing and support fees.

Looking forward

Law firm executives will continue to adopt strategies to protect profit margins amid sustained direct labor expenses. There are some low-hanging fruit opportunities—in addition to adjusting firm policies to capture missed billable time, for example, reducing travel can save both time and money.

But for some firms, these efforts may not be enough. Driving efficiency by conducting an application rationalization exercise to modernize and simplify technology landscapes will set firms apart in their ability to scale and drive value for clients. We expect this to be a significant focus for the next few years.

Lastly, layoffs will likely occur in select firms that are unable to turn productivity and profitability metrics around by the end of the year.

Let's Talk!

Call us at 1 855 363 3526 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Sonya King and originally appeared on 2023-01-17 RSM Canada, and is available online at https://rsmcanada.com/insights/industries/professional-services/law-firms-decreased-demand-increased-expenses-show-challenges-ahead.html.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

FCR a proud member of RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how FCR can assist you, please call us at 1 855 363 3526