Your Business News

3 questions to answer before your manufacturing company pulls back from China

August 15, 2023

Authored by RSM Canada LLP

Ian L. FitzPatrick, CPA,CA, CBV shared this article

ARTICLE | August 15, 2023

The picture of globalization is shifting, and manufacturers are diversifying risk away from China by reassessing alternative supply chain structures, even with the understanding that such changes may bring higher cost. This shift is unlikely to translate to a widespread reshoring of manufacturing operations back to the United States, but it does have many companies considering whether to continue their operations in China or direct some—or all—of those operations elsewhere.

Geopolitical tensions and rapidly shifting government policies in China—including a new data security law—have given many companies and investors cold feet about making additional investments there. Some U.S. companies that want to remain in China have taken extreme measures to separate their Chinese businesses from their U.S. operations. Such measures include relocating some intellectual property and data to China, where the U.S. business can no longer access it, to keep their foothold in the market.

Many businesses will need to maintain a presence in China because of its continued role as a trade powerhouse, but many will also likely hedge and diversify operations to other countries in Asia or somewhere in the Americas.

However, manufacturers weighing whether to reduce their footprint in China should not make that decision in haste. Given the shifts in globalization, businesses need to thoroughly examine whether diversifying their locations will maximize their long-run prospects. The forces that led an organization to start operations in China may not be the same as the forces now leading it to look elsewhere or rethink its business models. Many companies entered China seeking lower labor costs, whereas now the focus has shifted to reducing risk and disruptions to supply.

"The forces that led an organization to start operations in China may not be the same as the forces now leading it to look elsewhere or rethink its business models."

Matt Dollard, RSM US industrials senior analyst

Foreign direct investment: Signs of a shift

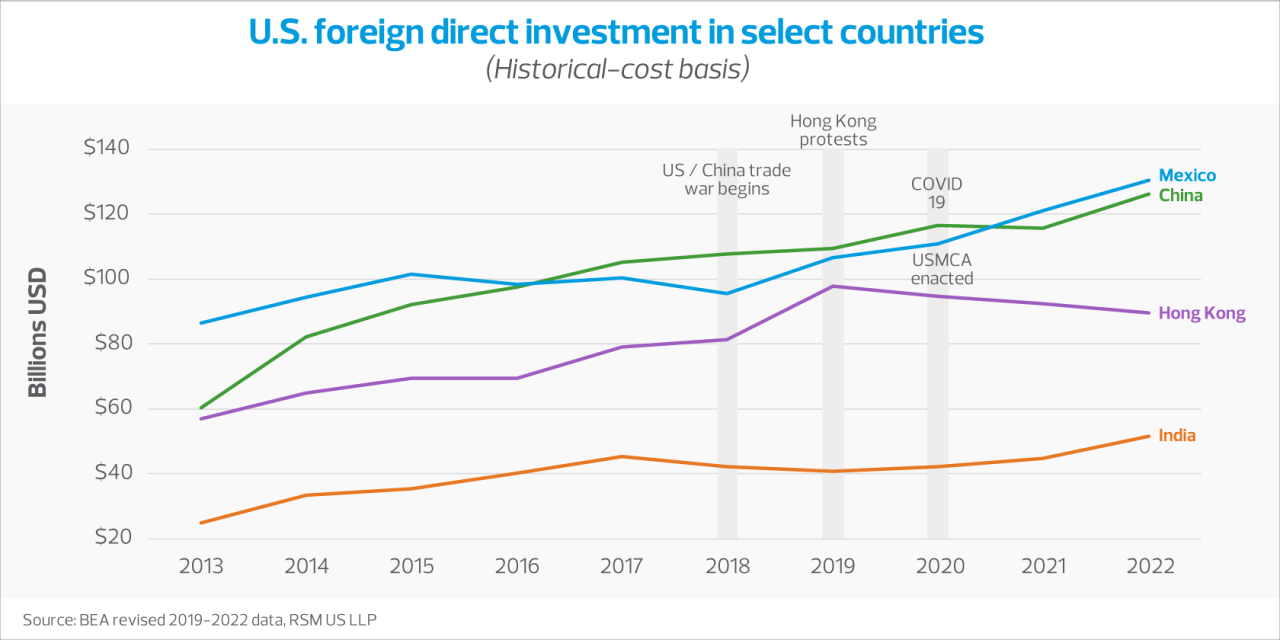

To be sure, U.S. foreign direct investment (FDI) in China has not ceased, but the landscape is shifting, with U.S. FDI into Mexico now ahead of China. U.S. FDI into China increased 17% from 2018—when the trade war began—to 2022, while FDI into Mexico grew 36% during that time, according to the U.S. Bureau of Economic Analysis.

In 2022, the U.S. invested $130 billion in Mexico compared to $126 billion in China. Also important to consider is U.S. FDI in Hong Kong, which soured after protests there against a 2019 bill that would have allowed extradition of Hong Kong residents to mainland China, and declined further after China passed a 2020 national security law that chilled Hong Kong’s pro-democracy movement and its business-friendly reputation. U.S. FDI in Hong Kong declined 9% from 2019 to 2022.

Along with proximity to the United States, the United States-Mexico-Canada Agreement, which went into effect in 2020, is clearly benefiting Mexico. This shift signals a pivot of investment back to North America.

But countries beyond North America are experiencing a shift too. U.S. FDI in India increased 22% from 2018 to 2022. India has the world’s second-largest workforce behind China and more favorable long-term demographics than that country, whose working-age population is shrinking as India’s continues to grow.

We expect to see a sharper increase in U.S. FDI into Mexico and India in 2023 and lower investment into China and Hong Kong.

Let's Talk!

Call us at 1 855 363 3526 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Matt Dollard and originally appeared on 2023-08-15 RSM Canada, and is available online at https://rsmcanada.com/insights/industries/manufacturing/manufacturing-company-pulls-back-from-china.html.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

FCR a proud member of RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how FCR can assist you, please call us at 1 855 363 3526