Tax cases of interest

Stay up-to-date with recent Court decisions on tax matters. Read about transfer pricing (Cameco) and FX trading losses (Paletta Estate).

The Atlantic Packaging v The Queen: When procedure trumps substance

When appealing a case in Tax Court, taxpayers should frame issues right from the audit stage to have a solid litigation backup.

Restrictive covenant and the share sale veto right

The Canada Federal Court of Appeals decision in Pangaea raises new considerations on the definition of restrictive covenants.

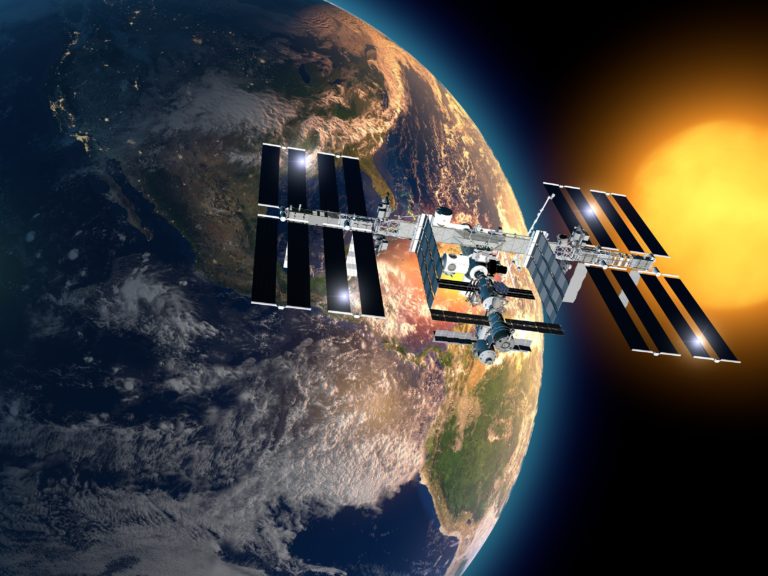

FCA confirms that a space trip is taxable to company shareholders

Find out how shareholder benefits could arise and the potential income tax implications as a result of the In Laliberté vs Canada decision.