Your Business News

Private credit and venture debt funds may capitalize on weakened equity markets

September 21, 2022

Authored by RSM Canada LLP

Mark Boivin CPA, CA, CBV shared this article

OUTLOOK | September 21, 2022

Private credit and venture debt funds have been on the rise in recent years and may stand to benefit in the economic environment expected to unfold over the next few quarters. Softened conditions in equity markets and the high-yielding segments of the credit markets usually portend a flight to quality, leading investors to gravitate toward the treasury markets or other safe-haven assets.

However, the current slowdown may prove to be a watershed moment for private credit and venture debt funds. Due to an alignment of factors, companies may turn to these funds for liquidity and capital, which in turn could entice investors to back these investment vehicles despite prevailing economic headwinds.

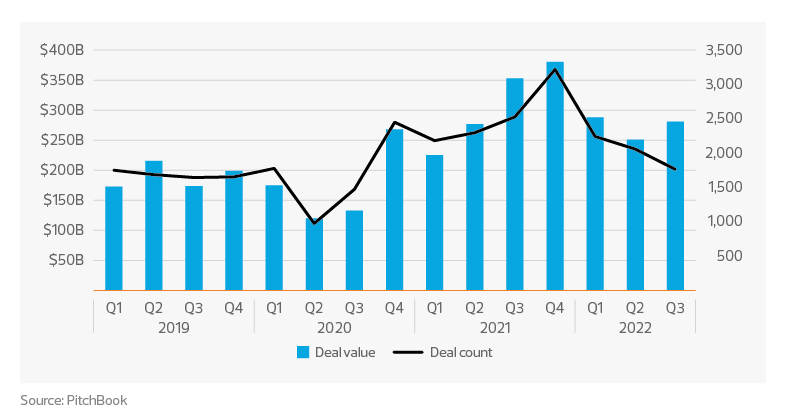

Venture debt deal activity

Following the stock market’s worst first half in over 50 years, public company multiples have compressed, and the initial public offering market has stalled, resulting in depressed valuations of private equity- and venture capital-backed companies. Prior to this slowdown, venture-backed companies had especially benefited from significant increases in enterprise value as they enjoyed big step-ups in valuations with each successive round of financing.

For venture-backed companies that successfully raised capital at attractive pricing during this era but did not conserve the cash, or that have a high cash burn and need to continually tap the market, or that simply missed the window before it closed, raising equity capital over the next few quarters will be challenging. The public and private markets will be difficult to navigate given the big declines in public company stock prices and the move by private equity and venture capital funds toward negotiating low prices while slowing the pace of their deployments and becoming more selective in their investments.

How private credit and venture debt funds can offer a solution

Given market conditions, companies may be forced to accept a down round or other unfavorable terms that will likely be dilutive in the future; if so, private credit and venture debt may be a solution. While the cost of this debt capital might be high, it could be a viable alternative for companies operating in industry verticals that have experienced big drawdowns in valuations. Such companies could experience significant dilution if they accept equity capital at reduced valuations relative to the peaks reached in late 2021 or earlier this year.

We expect more venture-backed companies to accept the higher cost of debt capital in exchange for preserving a bigger stake in the company for when market conditions improve. An increasing number of public companies will also explore private credit as an alternative financing source to avoid offering new shares at the current depressed levels.

The inflation backdrop may in some ways also work in favor of private credit and venture debt funds. While inflation can create challenging conditions for business operations, resulting in a deteriorated credit standing and therefore a higher credit risk for lenders, it also prompts investors to seek inflation hedges to conserve their capital in real terms. Although one would not immediately look to private credit and venture debt as natural hedges, their higher-yielding loan portfolios can be an attractive proposition in an inflationary environment, provided they have adequate downside protection.

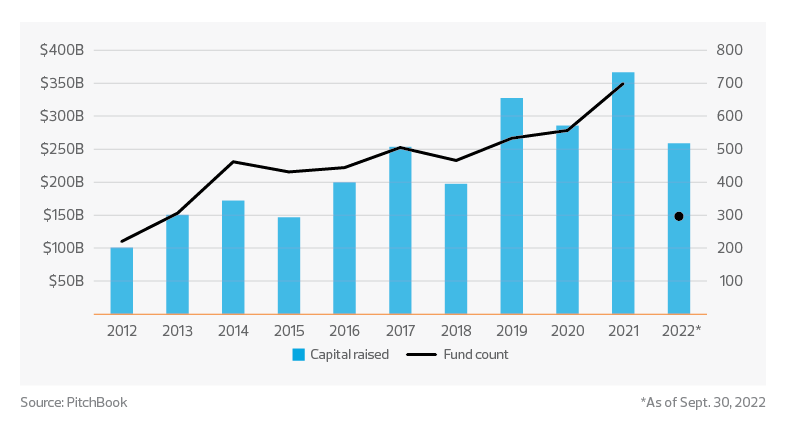

Private credit and venture debt funds have extended their reach over the years, and capital raising for this strategy has continued to increase over the past decade. These funds have amassed a healthy and diversified pipeline of potential borrowers, allowing them to manage risk in several ways.

Private debt - capital raised ($ billions)

To begin with, they can be selective about the credit they choose to underwrite. Private credit funds not only deal with borrowers with less than stellar credit profiles; they also now work with seasoned companies that may turn to them when complexity or the need for speed of execution makes the use of traditional lenders unworkable. This means that private credit funds now have more latitude to better manage the credit risk in their portfolio while still commanding better yields.

In an environment where traditional lenders are proceeding with caution, private credit funds can move in to fill the void. And the funds can do this while pushing for better loan terms that provide enhanced protection in the form of stricter covenants, more collateral, and seniority and preference in the capital stack.

Should private credit and venture debt funds step up to fulfill this role as expected in the coming quarters, they stand to gain further appeal with investors who are yield-hungry, concerned about downside risk and conscious about inflation. In addition, provided the economy experiences a mild slowdown, which minimizes the risk of defaults and credit losses, the current environment could be an opportunity for this strategy to gain a further foothold in the private capital markets and become a more established allocation in a greater number of institutional investors’ portfolios.

This content was originally published on RSMUS.com.

Let's Talk!

Call us at 1 855 363 3526 or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Kennedy Chinyamutangira and originally appeared on Sep 21, 2022 RSM Canada, and is available online at https://rsmcanada.com/insights/industries/asset-management/asset-management-outlook.html.

RSM Canada Alliance provides its members with access to resources of RSM Canada Operations ULC, RSM Canada LLP and certain of their affiliates (“RSM Canada”). RSM Canada Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM Canada. RSM Canada LLP is the Canadian member firm of RSM International, a global network of independent audit, tax and consulting firms. Members of RSM Canada Alliance have access to RSM International resources through RSM Canada but are not member firms of RSM International. Visit rsmcanada.com/aboutus for more information regarding RSM Canada and RSM International. The RSM trademark is used under license by RSM Canada. RSM Canada Alliance products and services are proprietary to RSM Canada.

FCR a proud member of RSM Canada Alliance, a premier affiliation of independent accounting and consulting firms across North America. RSM Canada Alliance provides our firm with access to resources of RSM, the leading provider of audit, tax and consulting services focused on the middle market. RSM Canada LLP is a licensed CPA firm and the Canadian member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM Canada Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how FCR can assist you, please call us at 1 855 363 3526